By IPPGW

Economic Pulse 2026: From Uncertainty to Renewal

24 December 2025

Written by IPP’s Director-Investment Strategist & Country Economist; Mohd Sedek bin Jantan

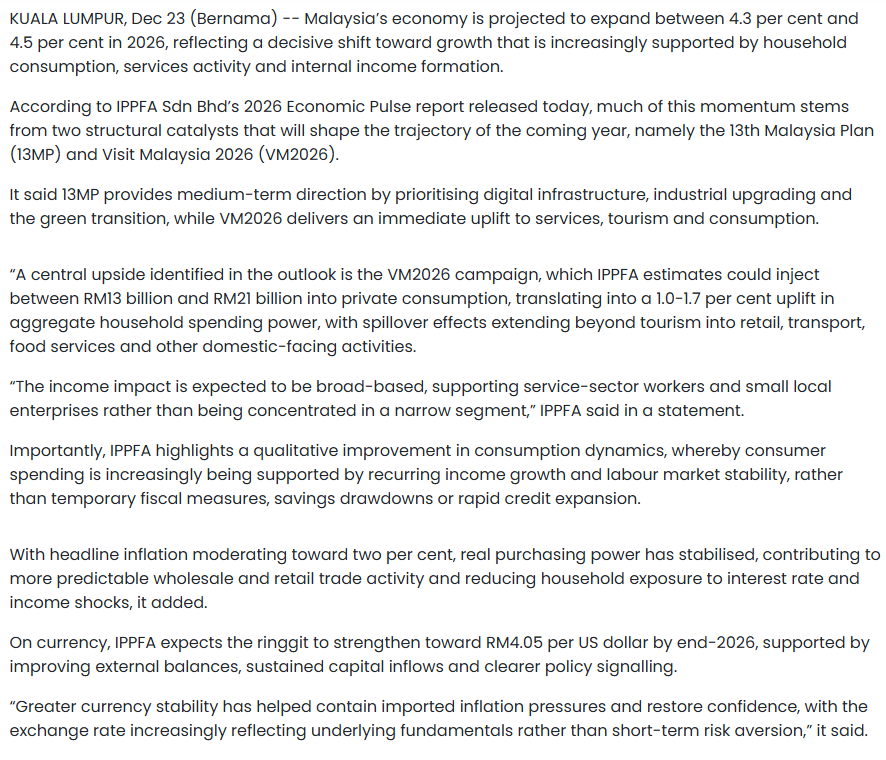

As Malaysia prepares for the year ahead, the 2026 Economic Pulse report reveals a nation transitioning from a period of global uncertainty to one of renewal and strengthened resilience. With a forecast GDP expansion of 4.3 to 4.5 per cent, Malaysia is positioning itself as a stable, neutral, and adaptive hub within an increasingly fragmented global landscape.

This outlook is built on several key pillars:

- A “Geoeconomic Hedge”: By embedding itself in a dense network of trade agreements—including the CPTPP, RCEP, and the strategic Malaysia–United States Agreement on Reciprocal Trade (ART)—Malaysia has successfully diversified its export destinations and cushioned itself against external shocks.

- Domestic Engines of Growth: Momentum is being driven by firmer domestic demand, stable wage gains, and the immediate uplift to services and tourism provided by the “Visit Malaysia 2026” campaign.

- Structural Transformation: The report highlights a shift toward high-tech growth, anchored by semiconductor reforms, digital infrastructure expansion, and the “AI Nation Development Framework”.

- Data Over Drama: In an age of headline-driven volatility, this analysis prioritises substance over sentiment, grounding its findings in real-economy signals like currency stability and predictable monetary policy.

While the aggregate narrative is constructive, the sources note that the true challenge of 2026 lies in bridging productivity gaps, particularly for MSMEs facing rising wage floors and heightened compliance obligations.

We invite you to read the full document to explore how Malaysia is converting cyclical resilience into durable structural gains and to understand the specific macro signals that will define the business and investment landscape in 2026.

_______________________________________________________________________________

Malaysia’s Economy to Expand 4.3-4.5 PCT in 2026, Driven by Domestic Demand

By IPPGW

Tuesday, 23 December 2025

Resources:

https://www.bernama.com/tv/news.php?id=2505495

_______________________________________________________________________________

IPP X TEC Economics Outlook 2026

By IPPGW

Friday, 12 December 2025

IPPFA was pleased to be involved in the IPP x TEC Economics Outlook 2026, a collaborative event organised in partnership with Taylor’s Economics Club (TEC), bringing together policymakers, industry professionals, academics, and students for an in-depth discussion on Malaysia’s economic outlook for 2026.

The session provided a valuable platform to exchange perspectives on economic resilience, investment trends, and structural developments shaping Malaysia and the broader ASEAN region. Discussions focused on translating macroeconomic themes into practical insights relevant for businesses, investors, and the next generation of finance professionals.

We would like to thank IPP Global Wealth for its continued support of knowledge-sharing initiatives, as well as Hansen Lye and Mohd Sedek J. for contributing their experience and insights to make this event meaningful and impactful. The collaboration reflects a shared commitment to bridging academic discourse, public policy considerations, and real-world financial practice.

Distinguished Speakers

The forum featured a diverse panel of speakers who shared perspectives across policy, markets, and investment practice, including:

- Y.B. Tuan Mohd Najwan Bin Halimi — youth empowerment, entrepreneurship, and state-level policies supporting resilient growth

- Mr Michael Wong — regional market dynamics and ASEAN investment strategies

- Ms Rejina Rahim — inclusive finance and women’s participation in capital markets

- Ms Mazlina Abdul Rahman — macroeconomic considerations for SMEs and financial integration

- Mr Wong K. — evolving investor behaviour, private credit, and digital assets

- Mr Devan Linus — talent development and skills for the investment management industry

- Dr. Hisham Hamzah, CFA, CA — long-term investing, asset allocation, and risk management

- Mr Wei Yine Tan, CFA, CB, CFP® — intermediary relationships, advisory practices, and client-focused portfolio strategies

- Mr John Lau, CFA — multi-asset portfolio management insights from the asset management perspective

Looking Ahead

IPPFA values opportunities to engage with academic institutions and industry partners to promote informed dialogue on economic and investment developments. Events such as this reinforce the importance of thoughtful analysis, professional standards, and long-term perspectives in navigating an increasingly complex economic environment.

We look forward to supporting future initiatives that contribute to deeper understanding, meaningful collaboration, and the continued development of Malaysia’s financial ecosystem.

_______________________________________________________________________________

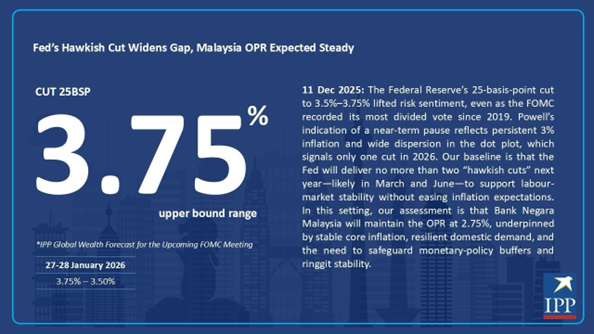

The Latest FOMC Update

Tuesday, 11 December 2025

The latest FOMC decision points to a cautious shift toward monetary easing, with the Federal Reserve delivering a third 25bps rate cut amid a notably divided vote. While inflation remains sticky and labour-market conditions are showing early signs of softening, policymakers continue to signal a broadly hawkish stance, prioritising inflation-control credibility over aggressive easing. Against this backdrop, we expect Bank Negara Malaysia to maintain the OPR at 2.75%, supporting policy stability, orderly credit conditions, and continued macro-financial resilience despite elevated global volatility.

_______________________________________________________________________________

IPP X TEC: Introduction to Wealth Managament

By IPPGW

Tuesday, 25 November 2025

IPPFA was pleased to support the IPP x TEC: Introduction to World of Wealth Management Education Session, organised in collaboration with Taylor’s Economics Club (TEC), as part of our ongoing commitment to financial literacy and investor education.

The session provided students with a practical introduction to investing, focusing on building strong foundations and long-term thinking. We thank IPPFA for partnering with us to deliver this initiative.

The session featured Hansen Lye, General Manager at IPPFA, who shared clear, real-world insights on wealth advisory and the components.

Key Takeaways

- Core wealth management principles, including risk management, diversification, market cycles, and compounding

- Defined objectives and long term perspective, with an emphasis on long-term goals over short-term market movements

Looking Ahead

IPPFA values collaborations that promote financial awareness and responsible investing. We look forward to supporting more educational initiatives that help build strong financial foundations for the next generation.

_______________________________________________________________________________

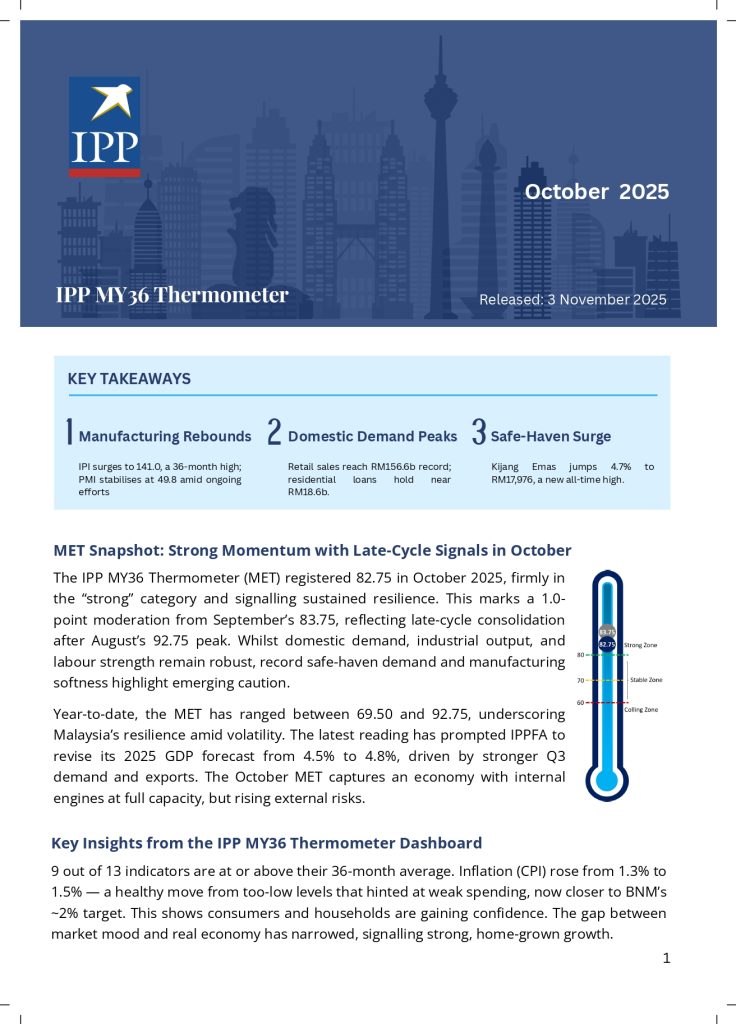

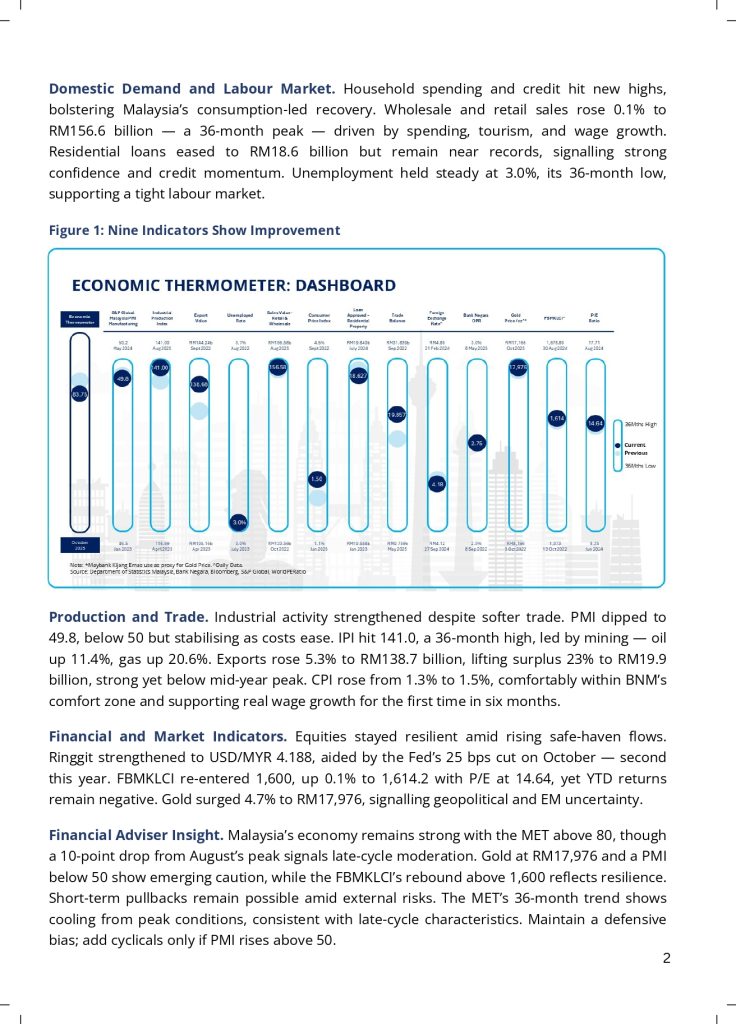

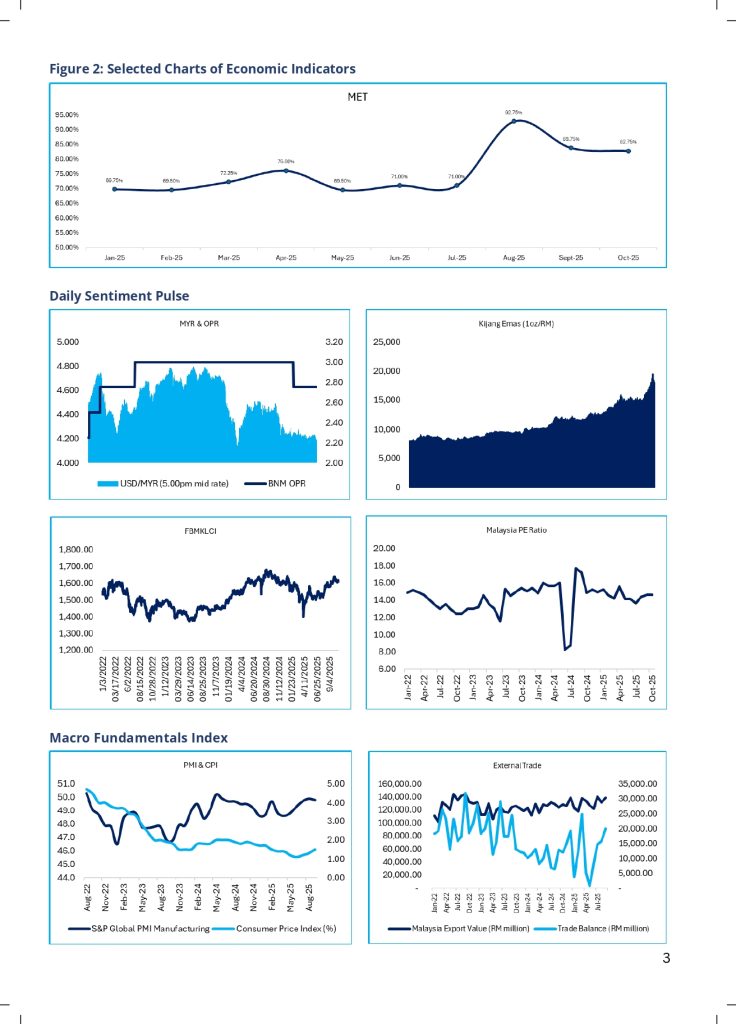

IPP MY36 Thermometer

October, 2025

This publication serves as a comprehensive economic monitoring report that synthesises key macroeconomic, financial, and market indicators to provide a clear assessment of Malaysia’s economic momentum and business cycle position. Using the IPP MY36 Thermometer framework, it translates complex data into structured insights on domestic demand, manufacturing activity, labour market conditions, inflation, and financial market trends. The report is designed to support informed decision-making by policymakers, investors, corporate leaders, and financial advisers by highlighting underlying strengths, emerging risks, and late-cycle signals. Overall, it functions as a strategic reference that enhances understanding of current economic conditions and supports forward-looking planning and risk management.